Claims Modernization - Where Moving from Legacy Matters Most

Feb 6, 2019

Insurers of all sizes are addressing the challenges of being held back by dated legacy systems. The reasons for this are many. First, the P&C market has experienced historic catastrophe losses, with claims recorded in 2017 at an all-time high. Largely the result of weather extremes, insurers have struggled to process and adjust more claims, while at the same time fighting forward to better price future risk.

Second, the insurtech world has created unique disruption, forcing incumbent insurers to rethink basic business models in order to successfully engage and retain customers. Competition is fierce, and insurers who don’t keep pace will be left behind. Third, the ever-increasing and ever-changing demands of those customers are also causing disruption, causing insurers to face a glut of new tools and technologies to support the new business processes required to exceed customer expectations.

The need for claims modernization

For insurers of all sizes, this confluence of market conditions creates a sense of urgency to address legacy modernization. Yet as is well known, insurers must also slog through layers of complexity, making the obvious solution not a simple, one-size-fits-all system or platform.

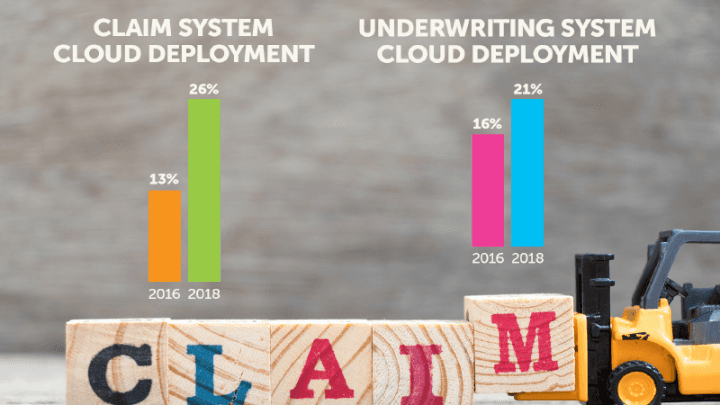

This is most apparent in the claims area, where insurers are beginning to understand the importance and benefits of that first step to legacy modernization: deploying core systems in the cloud. Ovum, a technology research firm that studied US insurers’ plans to deploy core functional systems such as claims and related fraud detection using Software as a Service, noted that the number of US insurers with claims systems deployed in the cloud increased from 13 percent in 2016 to 26 percent in 2018, and fraud detection from 16 to 21 percent during the same time period. These statistics are a sign that the industry is at last accepting the true limitations of legacy systems and trusting the Software as a Service/cloud platform to manage advanced capabilities, gain access to enhanced analytics and machine learning to improve overall loss ratios and make better business decisions, and fundamentally solidify a carrier’s value proposition.

While migrating from core legacy applications to a modern platform that includes analytics has obvious benefits in the claims area (fraud mitigation and early detection), the insights that are derived from this modern application can also help determine an insurer’s risk appetite. As just one example, the data from a host of internal sources (adjusters to SIUs) can be used to develop claims fraud indicators that are incorporated into an underwriting algorithm, providing the underwriter with the intelligence necessary to accept or reject a particular risk.

Healthier portfolios are possible

As a result, the insurer develops a healthier portfolio based on preferred risk. With a healthier financial outlook, the insurer can both reduce premiums and invest in other areas of the business, such as product development and improved customer service initiatives. And, as carriers continue to pursue legacy system modernization, more and more core business capabilities are likely to move into the cloud, creating further opportunities for efficiencies and growth across all functional business units.

For many insurers, the migration from legacy core systems to a flexible, modern platform involves a broader strategy of establishing basic priorities. In its “2019 Insurance Outlook,” report, Deloitte recommends that insurers take a phased approach, applying scoring rules based on business value, application complexity, and system criticality, which should enable them to identify which applications to migrate to the cloud and when. Our bet is in the claims area, where improved loss ratios are an imperative, customer satisfaction is critical and the possibilities for improvements are endless. Incorporating the newest technologies, even if over time, will enable an insurer of any size to compete in today’s demanding marketplace. More than just improving loss ratios and finding efficiencies, carriers will develop a stronger brand loyalty because they’ve been able to treat honest customers the way they deserve to be treated. Insurance isn't easy! Read more about some of the biggest challenges insurers are facing.