Revolutionize your claims verification process

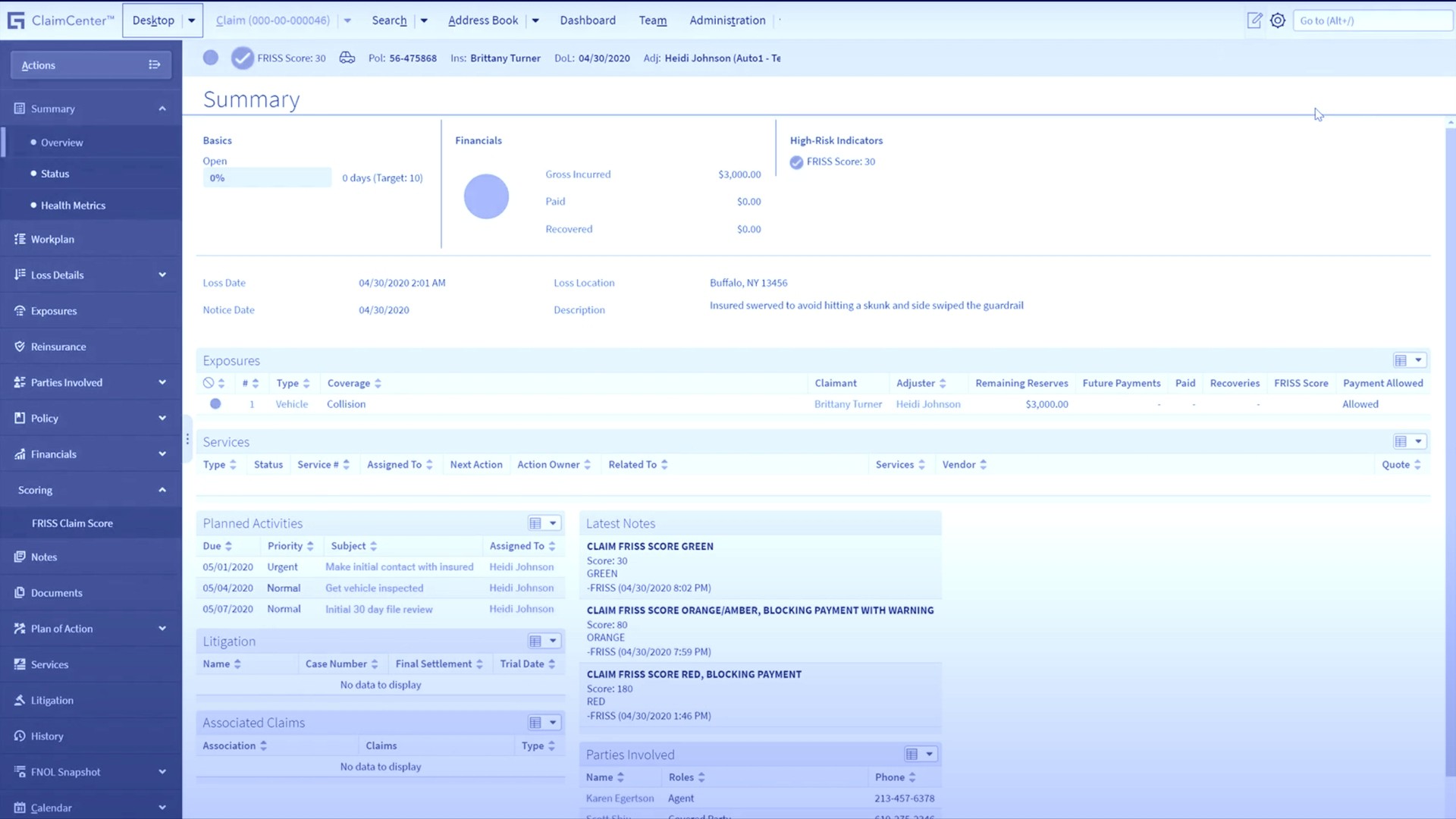

Elevate claims management by providing claims adjusters with advanced analytics and real-time insights to swiftly identify and combat fraud. Enhance efficiency, reduce losses, and ensure accurate claims processing for a seamless and secure insurance claims experience. Embark on a journey towards reduced loss ratios and increased profitability.

Because of a few bad apples every claim must be investigated. The Trust Automation Claims solution automatically tells you which claims you should trust and which ones require a deeper expert review to scout for fraud – so you only pay out legitimate claims.

Put honest claims on a fast track

Don't take our word for it, hear what insurance leaders are saying:

I am confident FRISS cares about the partnership with EMC and their people care about the work they do and developing the rapport with us while working on the product.

Cari McDaniel

SIU Manager EMC Insurance