Enable Confident Underwriting with Data-Driven Decisions

Empower your underwriters with a cutting-edge risk assessment solution that streamlines the underwriting process with advanced analytics and real-time insights. Enhance decision-making, reduce risks, and optimize efficiency with our innovative technology tailored for superior underwriting outcomes. Embark on a journey towards a balanced customer onboarding and healthy portfolio.

Trust takes time when establishing new relationships. The Trust Automation Underwriting solution assesses risks in real time – speeding up your decision on whether or not to trust the potential policy holder. This helps you grow a profitable and trustworthy portfolio.

Instantly accept customers with a low risk profile

Cut Processing Times by 50%

Increase efficiency with a fast and uniform underwriting process. Improve the quality and value of your portfolio. Use real-time risk assessment to enable underwriting decisions in a split second and build a healthier insurance portfolio.

Your benefits:

Enable Straight-Through Underwriting

Easily identify potential risks

Cut Processing Times by 50%

Increase efficiency with a fast and uniform underwriting process. Improve the quality and value of your portfolio. Use real-time risk assessment to enable underwriting decisions in a split second and build a healthier insurance portfolio.

Your benefits:

Enable Straight-Through Underwriting

Easily identify potential risks

Cut Processing Times by 50%

Increase efficiency with a fast and uniform underwriting process. Improve the quality and value of your portfolio. Use real-time risk assessment to enable underwriting decisions in a split second and build a healthier insurance portfolio.

Your benefits:

Enable Straight-Through Underwriting

Easily identify potential risks

100% Touchless Trust

Leverage internal and external data sources. Make predictive analytics actionable and apply customer value models. Make underwriting decisions instantly: Who am I doing business with? Am I allowed to do business with them? Do I want to do business with them?

Your benefits:

Easily avoid defaulters and high risks

Continuously monitor compliance

100% Touchless Trust

Leverage internal and external data sources. Make predictive analytics actionable and apply customer value models. Make underwriting decisions instantly: Who am I doing business with? Am I allowed to do business with them? Do I want to do business with them?

Your benefits:

Easily avoid defaulters and high risks

Continuously monitor compliance

100% Touchless Trust

Leverage internal and external data sources. Make predictive analytics actionable and apply customer value models. Make underwriting decisions instantly: Who am I doing business with? Am I allowed to do business with them? Do I want to do business with them?

Your benefits:

Easily avoid defaulters and high risks

Continuously monitor compliance

Increase Straight-Through Processing by 90%

Achieve digitalized and automated quotation, application, underwriting and renewal processes. Enable straight-through processing. Work more efficiently and effectively. Improve your customer experience with seamless customer onboarding.

Your benefits:

Consistent and reliable screenings

Minimize operational costs

Increase Straight-Through Processing by 90%

Achieve digitalized and automated quotation, application, underwriting and renewal processes. Enable straight-through processing. Work more efficiently and effectively. Improve your customer experience with seamless customer onboarding.

Your benefits:

Consistent and reliable screenings

Minimize operational costs

Increase Straight-Through Processing by 90%

Achieve digitalized and automated quotation, application, underwriting and renewal processes. Enable straight-through processing. Work more efficiently and effectively. Improve your customer experience with seamless customer onboarding.

Your benefits:

Consistent and reliable screenings

Minimize operational costs

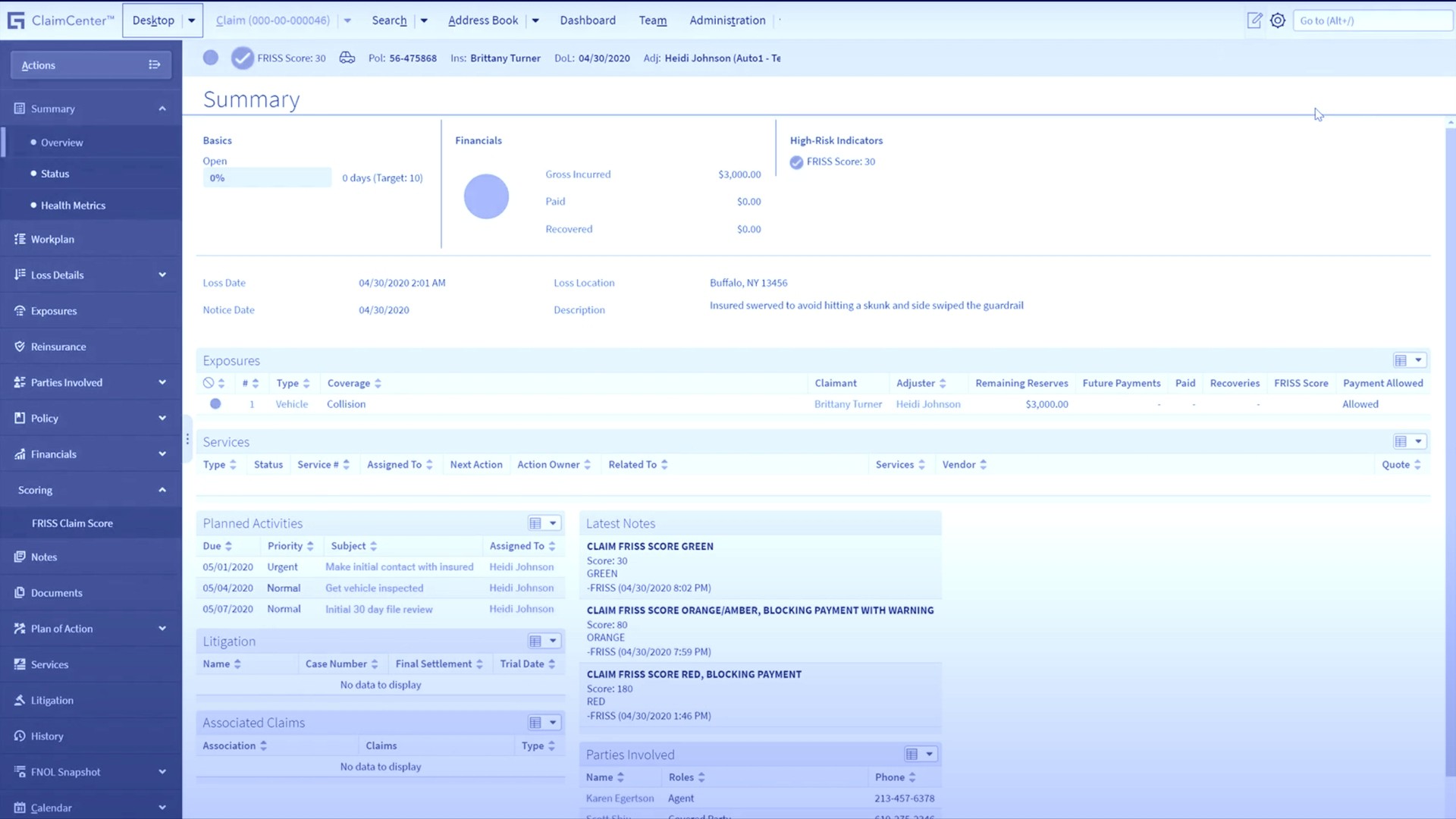

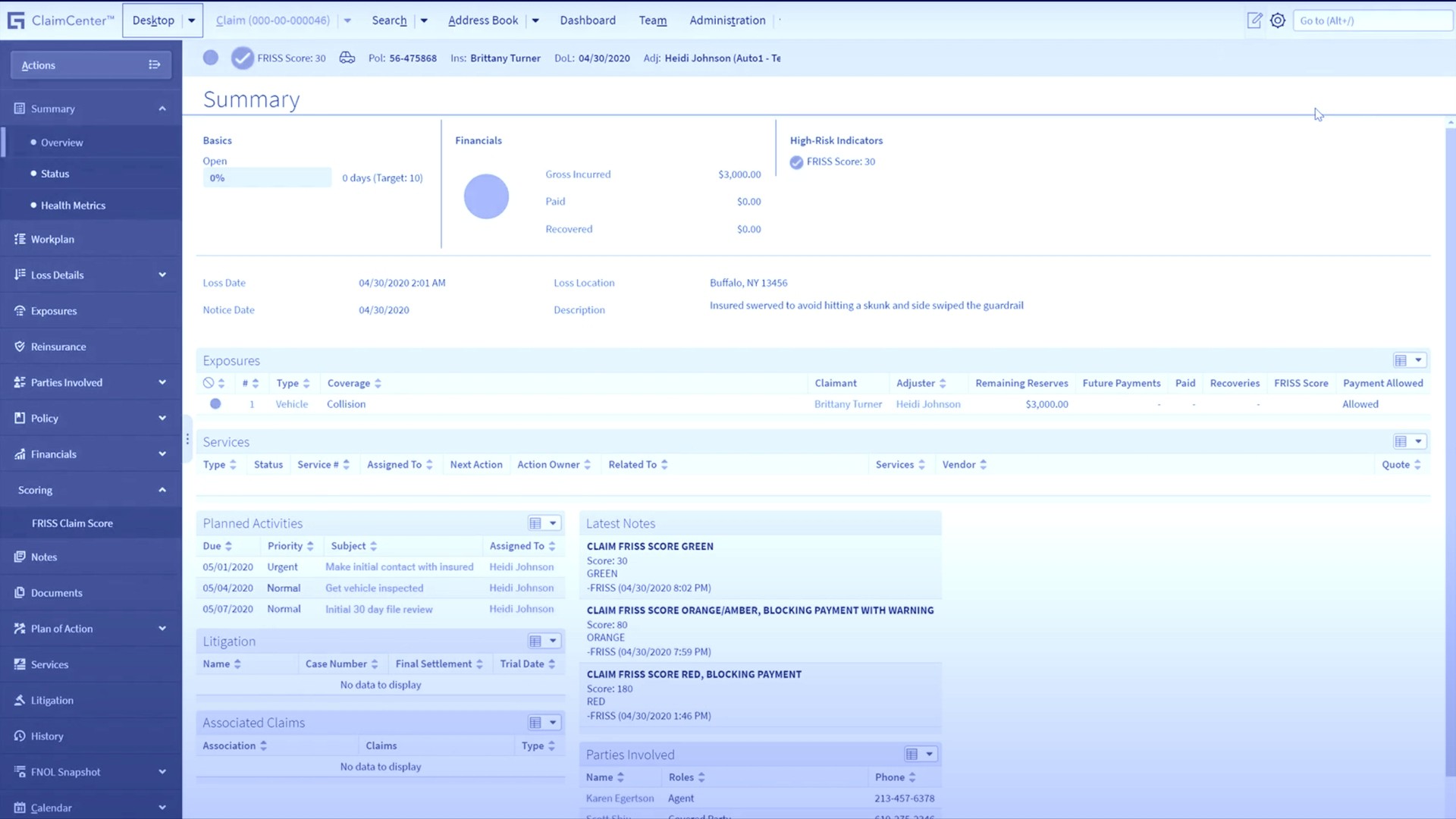

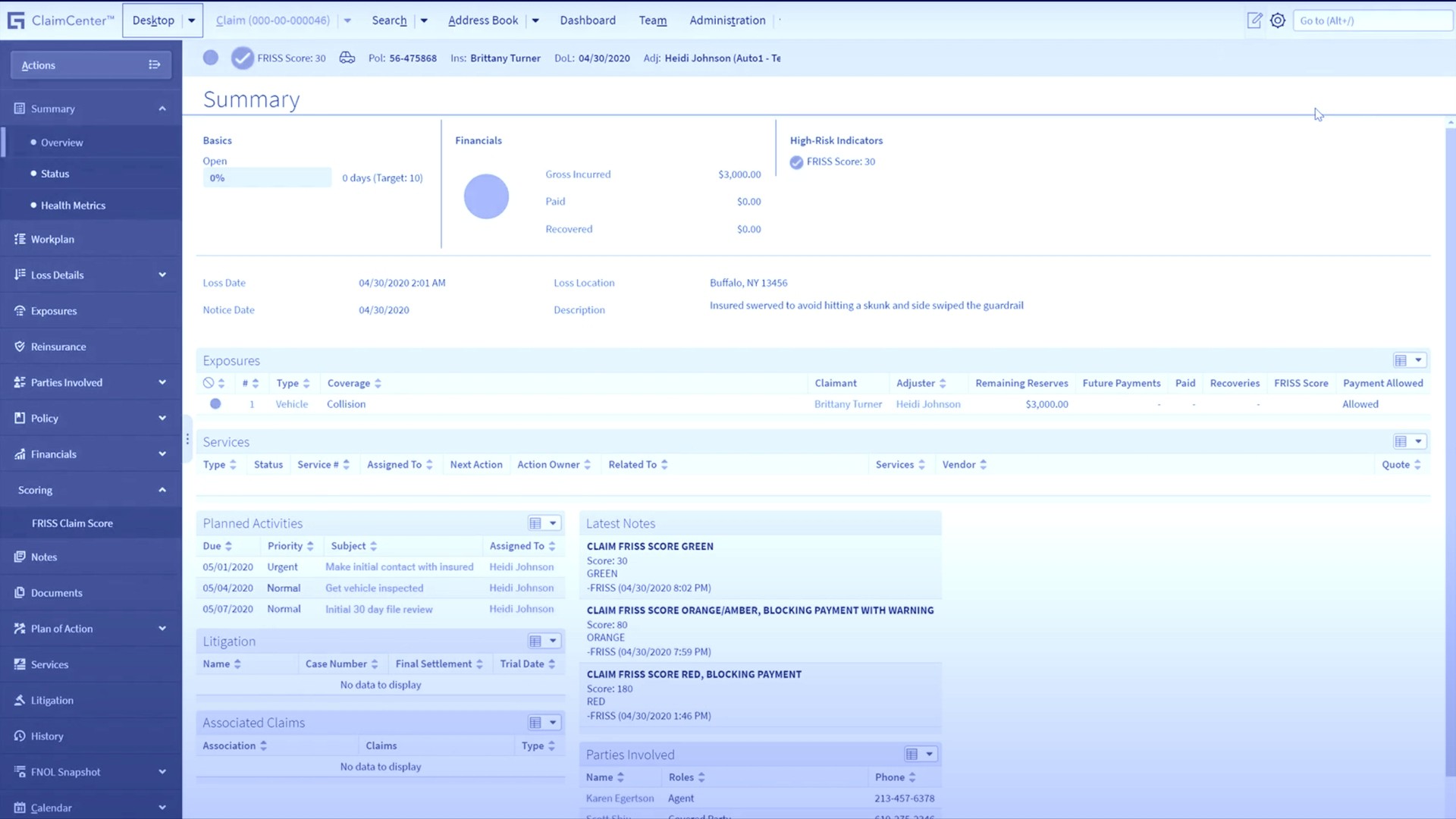

100% Seamless Workflows

Automatically and consistently screen policies and prospects according to your risk appetite. Establish a straight- through process by integrating seamlessly into Guidewire, Sapiens, Duck Creek, and any other core system with a minimal impact on resources from your IT department.

Your benefits:

Low risk, high impact onboarding

Instant value, reduced total cost of ownership

100% Seamless Workflows

Automatically and consistently screen policies and prospects according to your risk appetite. Establish a straight- through process by integrating seamlessly into Guidewire, Sapiens, Duck Creek, and any other core system with a minimal impact on resources from your IT department.

Your benefits:

Low risk, high impact onboarding

Instant value, reduced total cost of ownership

100% Seamless Workflows

Automatically and consistently screen policies and prospects according to your risk appetite. Establish a straight- through process by integrating seamlessly into Guidewire, Sapiens, Duck Creek, and any other core system with a minimal impact on resources from your IT department.

Your benefits:

Low risk, high impact onboarding

Instant value, reduced total cost of ownership

Don't take our word for it, hear what insurance leaders are saying:

RISK uses FRISS to perform important screenings during the seconds it takes to complete an application. We also call this touchless trust: all customers with a good risk profile are immediately accepted.

Tony Dingemanse

Director of Projects RISK Insurance

RISK uses FRISS to perform important screenings during the seconds it takes to complete an application. We also call this touchless trust: all customers with a good risk profile are immediately accepted.

Tony Dingemanse

Director of Projects RISK Insurance

RISK uses FRISS to perform important screenings during the seconds it takes to complete an application. We also call this touchless trust: all customers with a good risk profile are immediately accepted.

Tony Dingemanse

Director of Projects RISK Insurance

FRISS is automatically consulted for all new policy applications, whether direct or via an intermediary. The results of FRISS screenings are decisive and help us further decide what should be accepted, reviewed, or rejected.

Managing Director Tier 1 Carrier

FRISS is automatically consulted for all new policy applications, whether direct or via an intermediary. The results of FRISS screenings are decisive and help us further decide what should be accepted, reviewed, or rejected.

Managing Director Tier 1 Carrier

FRISS is automatically consulted for all new policy applications, whether direct or via an intermediary. The results of FRISS screenings are decisive and help us further decide what should be accepted, reviewed, or rejected.

Managing Director Tier 1 Carrier

Our underwriting process is a fully automated digital process. It is important that decisions should always be explainable. FRISS helps in this by sending all explanations along with the screening so that a rejection can be explained to the customer.

CX Expert

Tier 1 Global Carrier

Our underwriting process is a fully automated digital process. It is important that decisions should always be explainable. FRISS helps in this by sending all explanations along with the screening so that a rejection can be explained to the customer.

CX Expert

Tier 1 Global Carrier

Our underwriting process is a fully automated digital process. It is important that decisions should always be explainable. FRISS helps in this by sending all explanations along with the screening so that a rejection can be explained to the customer.

CX Expert

Tier 1 Global Carrier

Grow a profitable portfolio.

Improve your customer experience.

Straight-through

processing

Straight-through processing

Data-driven

underwriting

Data-driven

underwriting

Real-time

risk assessment

Real-time

risk assessment

Proven insurance

track record

Proven insurance

track record