The Fraud Triangle – An Understanding from a P&C Insurance Fraud Perspective

Jul 25, 2019

Jim Murphy, M.S., CFE

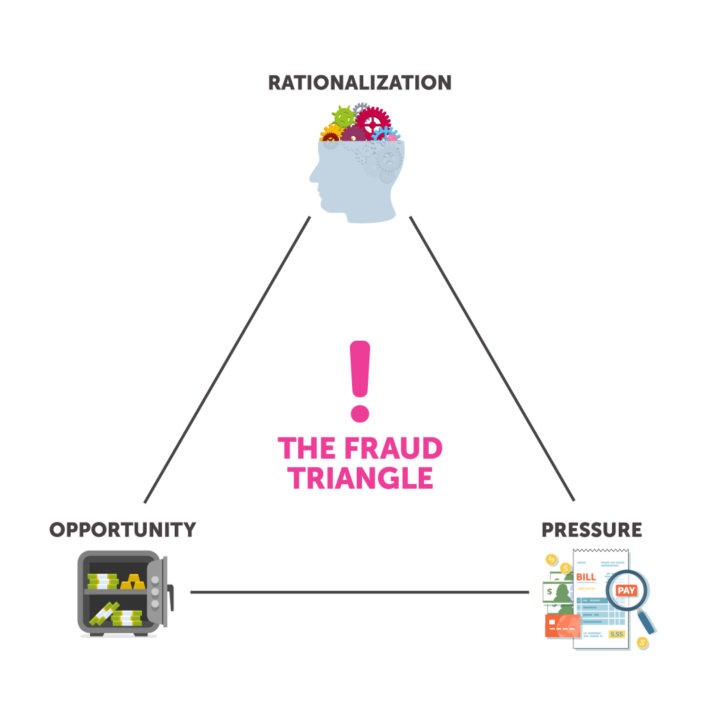

I learned about the fraud triangle many years ago while studying for my ACFE exam. The fraud triangle was created by Criminologist Donald Cressey in the 1950s to explain a person’s motivation to commit fraud. His hypothesis was based on interviews with prison inmates. Cressey theorized that you need three elements to be able to commit fraud:

Rationalization – the individual’s mindset and determination/justification that it’s okay to commit fraud or crime. “I’ve been paying my premium for decades… it’s my turn to cash in.”

Pressure – the motivation or reason to commit fraud. Examples include financial distress, drug or gambling addiction, or the desire to maintain a lavish lifestyle.

Opportunity – the ability to commit fraud. The lack of business control gives fraudsters the opportunity to commit a crime.

Types of Insurance Fraud

To commit fraud, Cressey’s underlying factor is that you need all three elements (rationalization, pressure, and opportunity). This theory applies to both opportunistic and organized fraud.

Opportunistic fraud, sometimes called soft fraud, occurs when a person exaggerates an otherwise legitimate claim or purposefully gives misinformation when applying for an insurance policy. Common examples include exaggerating injuries in an auto claim or inflating the value of items stolen during a home burglary. A research paper by the Association of British Insurers discovered that opportunistic fraud happens most often when a fraudster thinks he/she is doing nothing wrong or believes they will be successful in their scam.

Organized fraud, or hard fraud, is deliberate and takes planning often elaborate schemes among a group of people – sometimes including employees of an insurance company. Intentionally causing car accidents or submitting medical claims for services that were not needed or rendered are examples of everyday organized fraud that often go unnoticed and unpunished.

Check out Fraud Report 2024!

Which aspect of the fraud triangle can insurers control?

Why should I care about the fraud triangle if I am a Chief Claims Officer or an investigator for a P&C insurer? Great question.

My view is that nobody has the ability to control another person’s rationalization. This is both fortunate and unfortunate. It goes back to how someone was brought up, including their morals and other life experiences.

Further, life happens. Extensive medical bills or the loss of a loved one who is the main breadwinner can be a real hardship. This pressure can be a significant motivator, especially if there are creditors knocking on the door. Individuals may believe they have no way to get out of the financial hole they are facing.

Thus, rationalization and pressure are closely tied together. If a person believes it’s easy to steal and they will get away with it, then why not? There is an opportunity. Now they can go ahead and actually commit the fraud since there is nothing in the way to stop them.

Therefore, insurance companies have a hard time controlling rationalization or pressure. What they can control is an opportunity by putting important controls in place or installing fraud detection technology.

Risk detection platforms stop fraudsters at both underwriting and claims. This model is made up of artificial intelligence, text mining, expert rules, anomaly detection, third-party data sources and predictive models that close the opportunity gap. For example, FRISS’ Trust Automation platform flags out suspicious behavior instantly because the software is trained to recognize not only common fraud schemes but also to make connections between dubious information from different data sources. Using the latest technology insurers can prevent fraud before it happens and stay ahead of the fraudsters.

About the author

Jim Murphy has a specialized Master’s degree in Economic Crime Management and is a 30-year veteran of the insurance industry. He served as a police officer in New England and spent years running a Special Investigations Unit analyst team. He's always looking to making insurance more honest.