Enable Confident Underwriting with Data-Driven Decisions

Empower your underwriters with a cutting-edge risk assessment solution that streamlines the underwriting process with advanced analytics and real-time insights. Enhance decision-making, reduce risks, and optimize efficiency with our innovative technology tailored for superior underwriting outcomes. Embark on a journey towards a balanced customer onboarding and healthy portfolio.

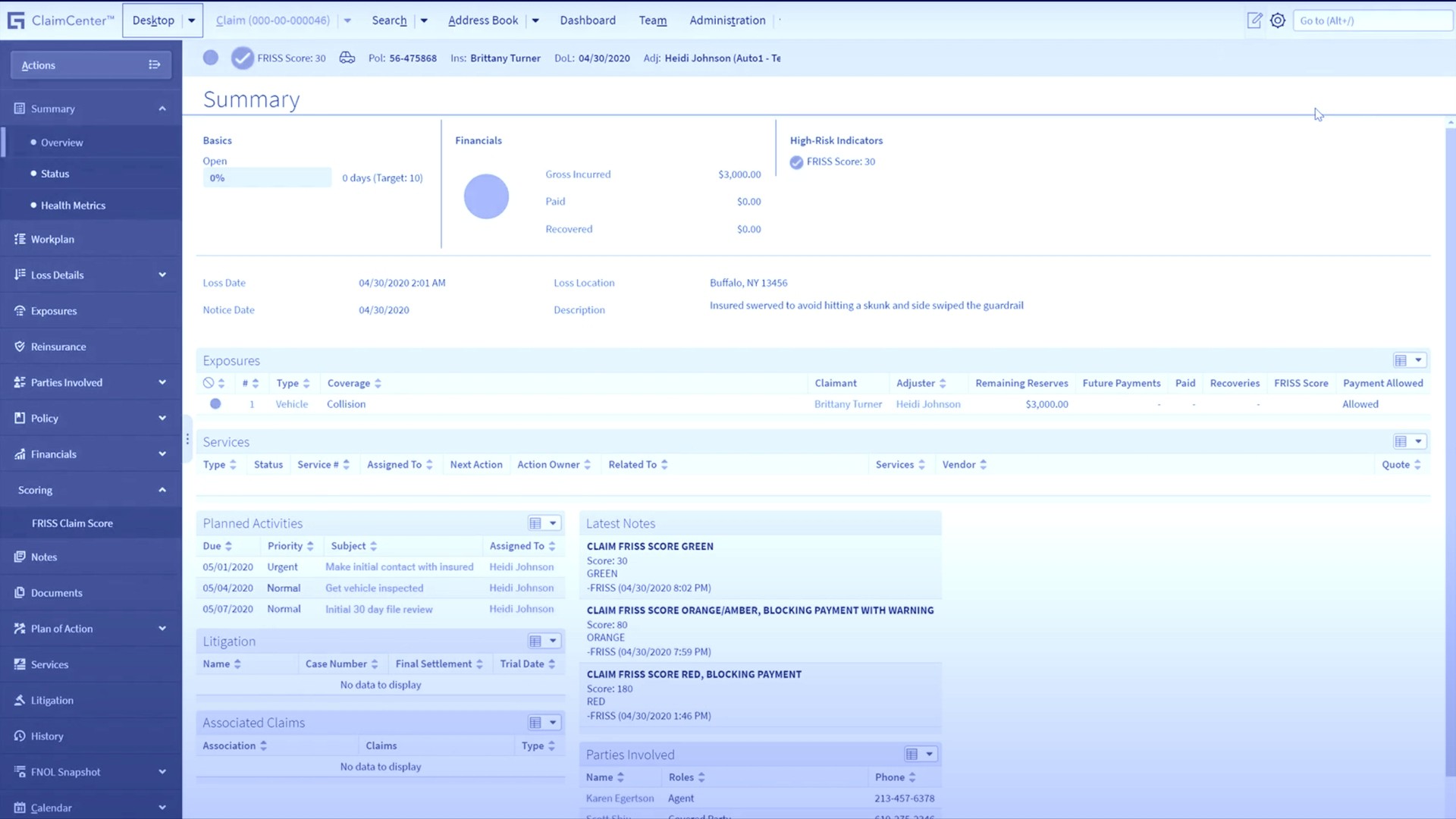

Trust takes time when establishing new relationships. The Trust Automation Underwriting solution assesses risks in real time – speeding up your decision on whether or not to trust the potential policy holder. This helps you grow a profitable and trustworthy portfolio.

Instantly accept customers with a low risk profile

Don't take our word for it, hear what insurance leaders are saying:

RISK uses FRISS to perform important screenings during the seconds it takes to complete an application. We also call this touchless trust: all customers with a good risk profile are immediately accepted.

Tony Dingemanse

Director of Projects RISK Insurance