Revolutionize your claims verification process

Elevate claims management by providing claims adjusters with advanced analytics and real-time insights to swiftly identify and combat fraud. Enhance efficiency, reduce losses, and ensure accurate claims processing for a seamless and secure insurance claims experience. Embark on a journey towards reduced loss ratios and increased profitability.

Because of a few bad apples every claim must be investigated. The Trust Automation Claims solution automatically tells you which claims you should trust and which ones require a deeper expert review to scout for fraud – so you only pay out legitimate claims.

Put honest claims on a fast track

66% Decrease in Claims Handling Time

Our AI-Powered Insurance Fraud Detection software automatically detects suspicious claims, reveals networks, and discovers hidden patterns. Safely automate your processes, while leveraging transparent predictive models and text mining.

Your benefits:

Direct bottom line savings

Real-time actionable claim insights

66% Decrease in Claims Handling Time

Our AI-Powered Insurance Fraud Detection software automatically detects suspicious claims, reveals networks, and discovers hidden patterns. Safely automate your processes, while leveraging transparent predictive models and text mining.

Your benefits:

Direct bottom line savings

Real-time actionable claim insights

66% Decrease in Claims Handling Time

Our AI-Powered Insurance Fraud Detection software automatically detects suspicious claims, reveals networks, and discovers hidden patterns. Safely automate your processes, while leveraging transparent predictive models and text mining.

Your benefits:

Direct bottom line savings

Real-time actionable claim insights

75% Reduction in False Positives

Use automated fraud detection in your claims processes to reduce the number of false positives and score your claims in real time. Immediately reduce your number of referrals to SIU, process honest claims instantly, and increase customer satisfaction at the same time.

Your benefits:

Reduce false positives

Enable a frictionless customer experience

75% Reduction in False Positives

Use automated fraud detection in your claims processes to reduce the number of false positives and score your claims in real time. Immediately reduce your number of referrals to SIU, process honest claims instantly, and increase customer satisfaction at the same time.

Your benefits:

Reduce false positives

Enable a frictionless customer experience

75% Reduction in False Positives

Use automated fraud detection in your claims processes to reduce the number of false positives and score your claims in real time. Immediately reduce your number of referrals to SIU, process honest claims instantly, and increase customer satisfaction at the same time.

Your benefits:

Reduce false positives

Enable a frictionless customer experience

Increase Fast-Tracked Claims to 90%

Pay out genuine claims faster to improve your end-to-end customer experience. Mitigate risks with uniform and data-driven screening to maximize accuracy. Automatically detect suspicious claims. Safely enable straight-through processing.

Your benefits:

Proactive claims monitoring

Customer-centric workflow enablement

Increase Fast-Tracked Claims to 90%

Pay out genuine claims faster to improve your end-to-end customer experience. Mitigate risks with uniform and data-driven screening to maximize accuracy. Automatically detect suspicious claims. Safely enable straight-through processing.

Your benefits:

Proactive claims monitoring

Customer-centric workflow enablement

Increase Fast-Tracked Claims to 90%

Pay out genuine claims faster to improve your end-to-end customer experience. Mitigate risks with uniform and data-driven screening to maximize accuracy. Automatically detect suspicious claims. Safely enable straight-through processing.

Your benefits:

Proactive claims monitoring

Customer-centric workflow enablement

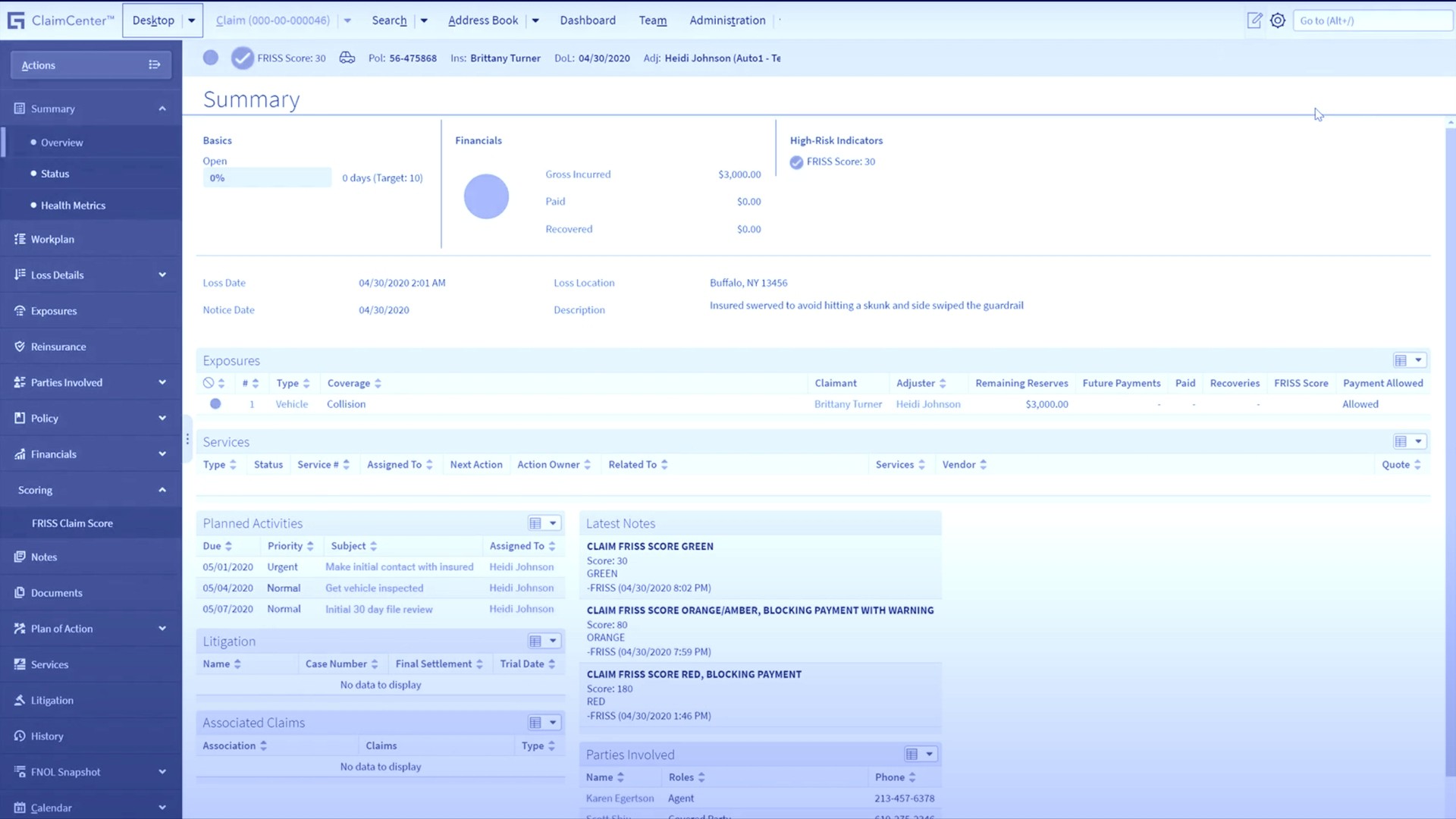

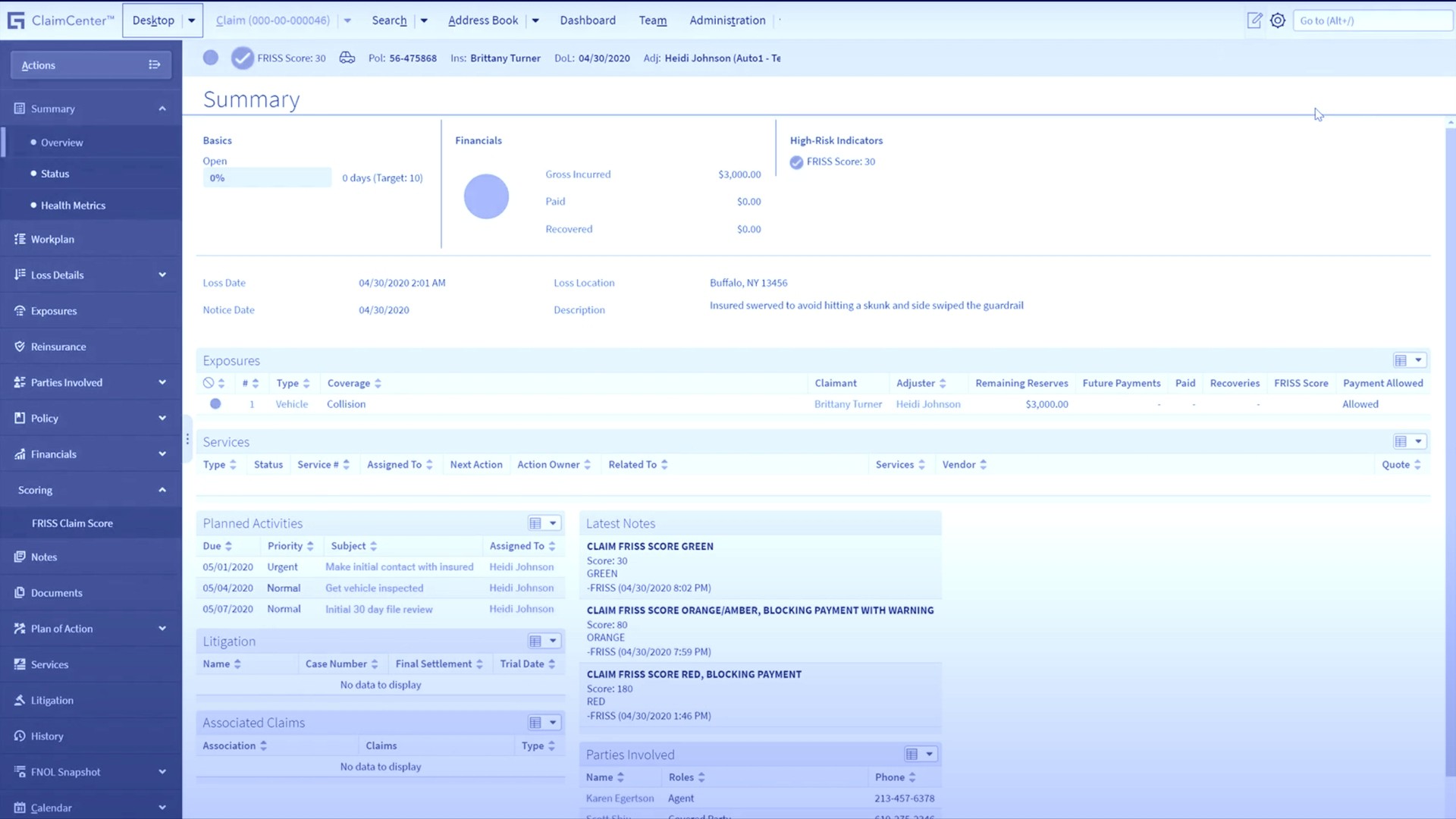

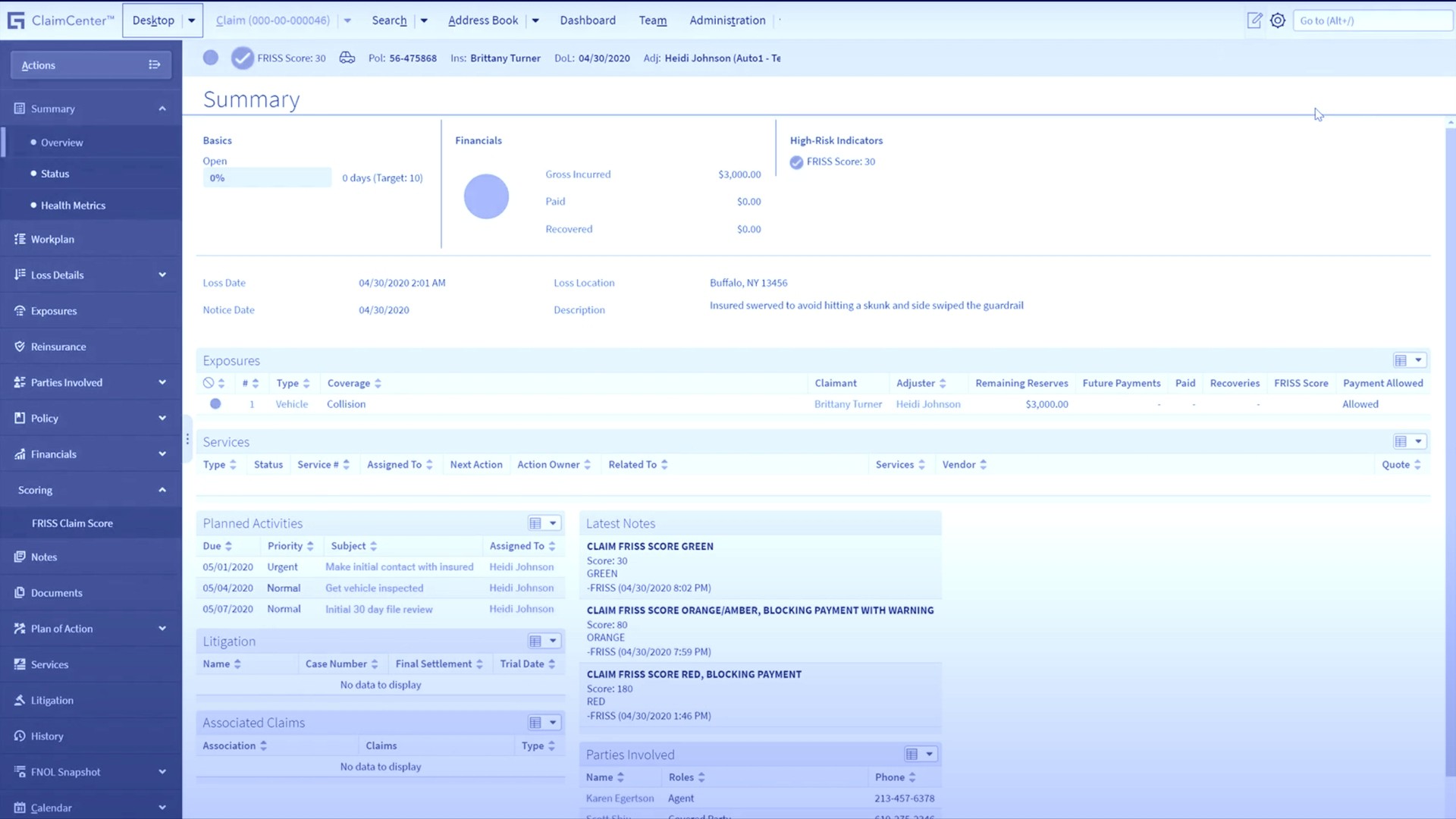

$9.2 Million in Fraud Savings Annually

Automatically and consistently screen policies and prospects according to your risk appetite. Establish a straight- through process by integrating seamlessly into Guidewire, Sapiens, Duck Creek, and any other core system with a minimal impact on resources from your IT department.

Your benefits:

Low risk, high impact onboarding

Instant value, reduced total cost of ownership

$9.2 Million in Fraud Savings Annually

Automatically and consistently screen policies and prospects according to your risk appetite. Establish a straight- through process by integrating seamlessly into Guidewire, Sapiens, Duck Creek, and any other core system with a minimal impact on resources from your IT department.

Your benefits:

Low risk, high impact onboarding

Instant value, reduced total cost of ownership

$9.2 Million in Fraud Savings Annually

Automatically and consistently screen policies and prospects according to your risk appetite. Establish a straight- through process by integrating seamlessly into Guidewire, Sapiens, Duck Creek, and any other core system with a minimal impact on resources from your IT department.

Your benefits:

Low risk, high impact onboarding

Instant value, reduced total cost of ownership

Don't take our word for it, hear what insurance leaders are saying:

By separating claims with low risk of fraud on a fast track, it standardizes and further speeds up claims screening at greater accuracy.

Blair Turnbull

CEO Tower Insurance

By separating claims with low risk of fraud on a fast track, it standardizes and further speeds up claims screening at greater accuracy.

Blair Turnbull

CEO Tower Insurance

By separating claims with low risk of fraud on a fast track, it standardizes and further speeds up claims screening at greater accuracy.

Blair Turnbull

CEO Tower Insurance

Thanks to FRISS, we realized a total fraud savings of $21million within the first 2 years of being live, and increased our fraud savings per investigator from $550.000 to $2million.

Irene Reihs

Project Leader UNIQA

Thanks to FRISS, we realized a total fraud savings of $21million within the first 2 years of being live, and increased our fraud savings per investigator from $550.000 to $2million.

Irene Reihs

Project Leader UNIQA

Thanks to FRISS, we realized a total fraud savings of $21million within the first 2 years of being live, and increased our fraud savings per investigator from $550.000 to $2million.

Irene Reihs

Project Leader UNIQA

Reduce your claims leakage.

Improve your customer experience.

Reduce your claims leakage.Improve your customer experience.

Real-time

fraud detection

Real-time

fraud detection

P&C insurance

knowledge

P&C insurance

knowledge

Proven insurance

track record

Proven insurance

track record

Seamless core system integrations

Seamless core system integrations