Fully understand your commercial risks

Empower your commercial lines underwriters by delivering real-time intelligence and advanced analytics on commercial risks. Elevate decision-making, mitigate risks, and optimize underwriting efficiency for superior outcomes in the dynamic landscape of commercial insurance. Embark on a journey towards a balanced customer onboarding and healthy portfolio.

By combining the power of data analytics and unprecedented speed, you will enable your commercial underwriters with actionable insights – so you can TRUST the information submitted by policy applicants and write only the risks you approve of.

Improve turnaround time from days to just minutes

Risk Insights

Data gathering is enriched and simplified, by aggregating information from traditional and nontraditional sources to build a true picture of each risk. The advanced, easy-to-use solution with an extremely user-friendly interface, takes on the chore so you can focus on the core – quality underwriting.

Your benefits:

90% time savings for writing new policies

Comprehensive risk assessment

Insights and analytics on risk attributes

Risk Insights

Data gathering is enriched and simplified, by aggregating information from traditional and nontraditional sources to build a true picture of each risk. The advanced, easy-to-use solution with an extremely user-friendly interface, takes on the chore so you can focus on the core – quality underwriting.

Your benefits:

90% time savings for writing new policies

Comprehensive risk assessment

Insights and analytics on risk attributes

Risk Insights

Data gathering is enriched and simplified, by aggregating information from traditional and nontraditional sources to build a true picture of each risk. The advanced, easy-to-use solution with an extremely user-friendly interface, takes on the chore so you can focus on the core – quality underwriting.

Your benefits:

90% time savings for writing new policies

Comprehensive risk assessment

Insights and analytics on risk attributes

NAICS Classification

Calculate risks based on current conditions and uncover violations, business practices and previously hidden information. NAICS classification helps ensure honesty, verify necessary licenses and inspections, and allows you to properly write the business you want in your portfolio.

Your benefits:

Know your Customer’s Operation

Understand if there are multiple operations

Gather information/manage filters based on Carrier’s appetite

NAICS Classification

Calculate risks based on current conditions and uncover violations, business practices and previously hidden information. NAICS classification helps ensure honesty, verify necessary licenses and inspections, and allows you to properly write the business you want in your portfolio.

Your benefits:

Know your Customer’s Operation

Understand if there are multiple operations

Gather information/manage filters based on Carrier’s appetite

NAICS Classification

Calculate risks based on current conditions and uncover violations, business practices and previously hidden information. NAICS classification helps ensure honesty, verify necessary licenses and inspections, and allows you to properly write the business you want in your portfolio.

Your benefits:

Know your Customer’s Operation

Understand if there are multiple operations

Gather information/manage filters based on Carrier’s appetite

Book Snapshot

Receive updated information covering every aspect of the underwriting process: liabilities, violations, special conditions, and many more. Feel more confident in your underwriting decisions, and always know exactly the risk level of their portfolio.

Your benefits:

Audit/Review of programs/MGAs/MGUs/Book Rollovers/M&A’s

Reinsure with confidence

Portfolio insights for renewal/risk control

Book Snapshot

Receive updated information covering every aspect of the underwriting process: liabilities, violations, special conditions, and many more. Feel more confident in your underwriting decisions, and always know exactly the risk level of their portfolio.

Your benefits:

Audit/Review of programs/MGAs/MGUs/Book Rollovers/M&A’s

Reinsure with confidence

Portfolio insights for renewal/risk control

Book Snapshot

Receive updated information covering every aspect of the underwriting process: liabilities, violations, special conditions, and many more. Feel more confident in your underwriting decisions, and always know exactly the risk level of their portfolio.

Your benefits:

Audit/Review of programs/MGAs/MGUs/Book Rollovers/M&A’s

Reinsure with confidence

Portfolio insights for renewal/risk control

ACORD Ingestion

Use ACORD forms to create a baseline for risk assessment. Automate the process of inputting and reviewing information. Get a thorough report that combines information in the documents and our own risk assessment. Free up more of your time.

Your benefits:

Automated Data Ingestion

Trigger Underwriting Insights using ACORD data

Improve data completeness and accuracy

ACORD Ingestion

Use ACORD forms to create a baseline for risk assessment. Automate the process of inputting and reviewing information. Get a thorough report that combines information in the documents and our own risk assessment. Free up more of your time.

Your benefits:

Automated Data Ingestion

Trigger Underwriting Insights using ACORD data

Improve data completeness and accuracy

ACORD Ingestion

Use ACORD forms to create a baseline for risk assessment. Automate the process of inputting and reviewing information. Get a thorough report that combines information in the documents and our own risk assessment. Free up more of your time.

Your benefits:

Automated Data Ingestion

Trigger Underwriting Insights using ACORD data

Improve data completeness and accuracy

Don't take our word for it, hear what insurance leaders are saying:

The business underwriters went through 300 submissions a week with the help of Underwriting Insights, which would otherwise require twice the staff.

Senior VP & Head of Casualty Business Tier 1 US Carrier

The business underwriters went through 300 submissions a week with the help of Underwriting Insights, which would otherwise require twice the staff.

Senior VP & Head of Casualty Business Tier 1 US Carrier

The business underwriters went through 300 submissions a week with the help of Underwriting Insights, which would otherwise require twice the staff.

Senior VP & Head of Casualty Business Tier 1 US Carrier

We noted a decrease in misinformation and estimated that our time savings increased by roughly 90%.

Tier 2 US Carrier

We noted a decrease in misinformation and estimated that our time savings increased by roughly 90%.

Tier 2 US Carrier

We noted a decrease in misinformation and estimated that our time savings increased by roughly 90%.

Tier 2 US Carrier

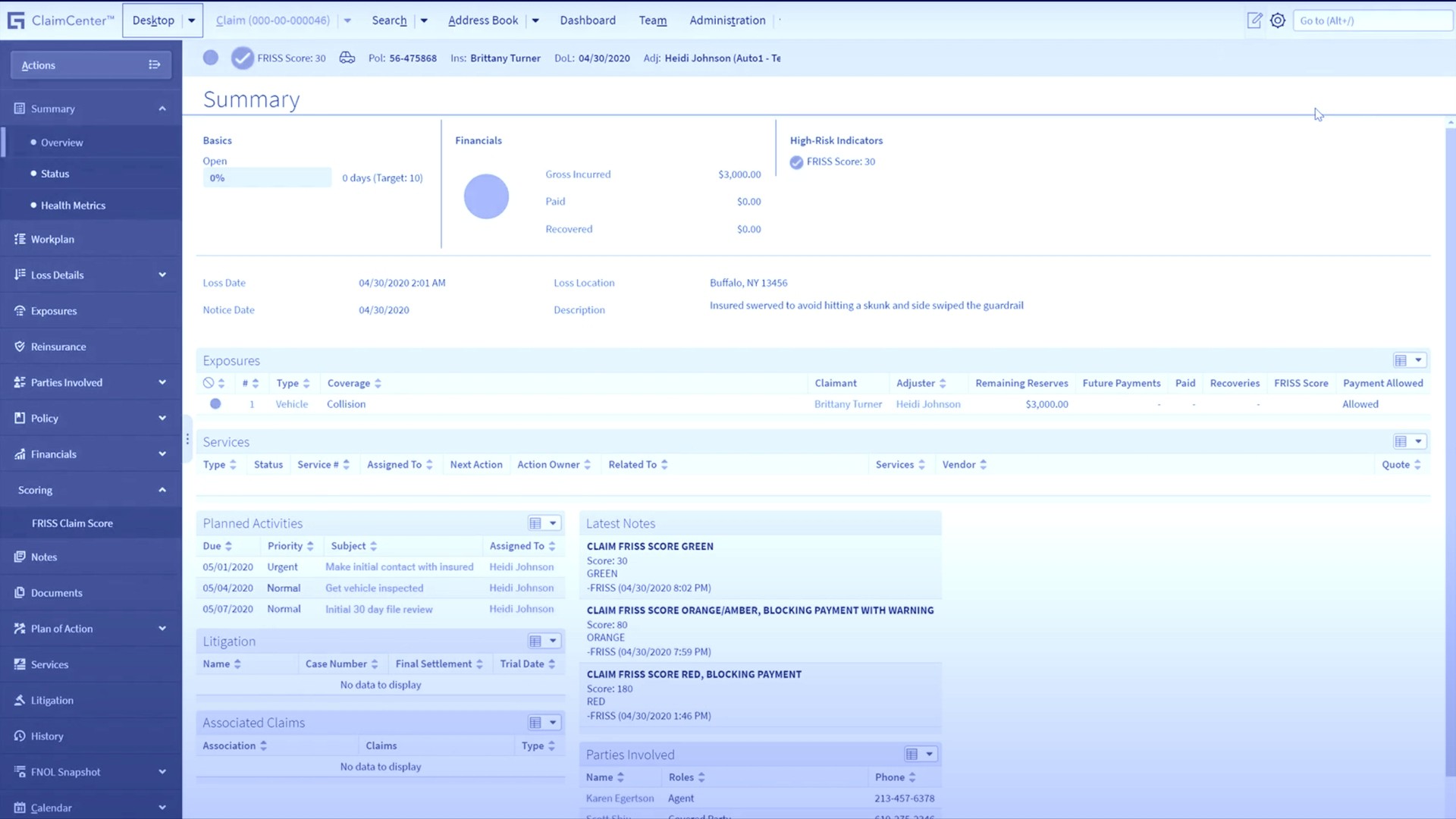

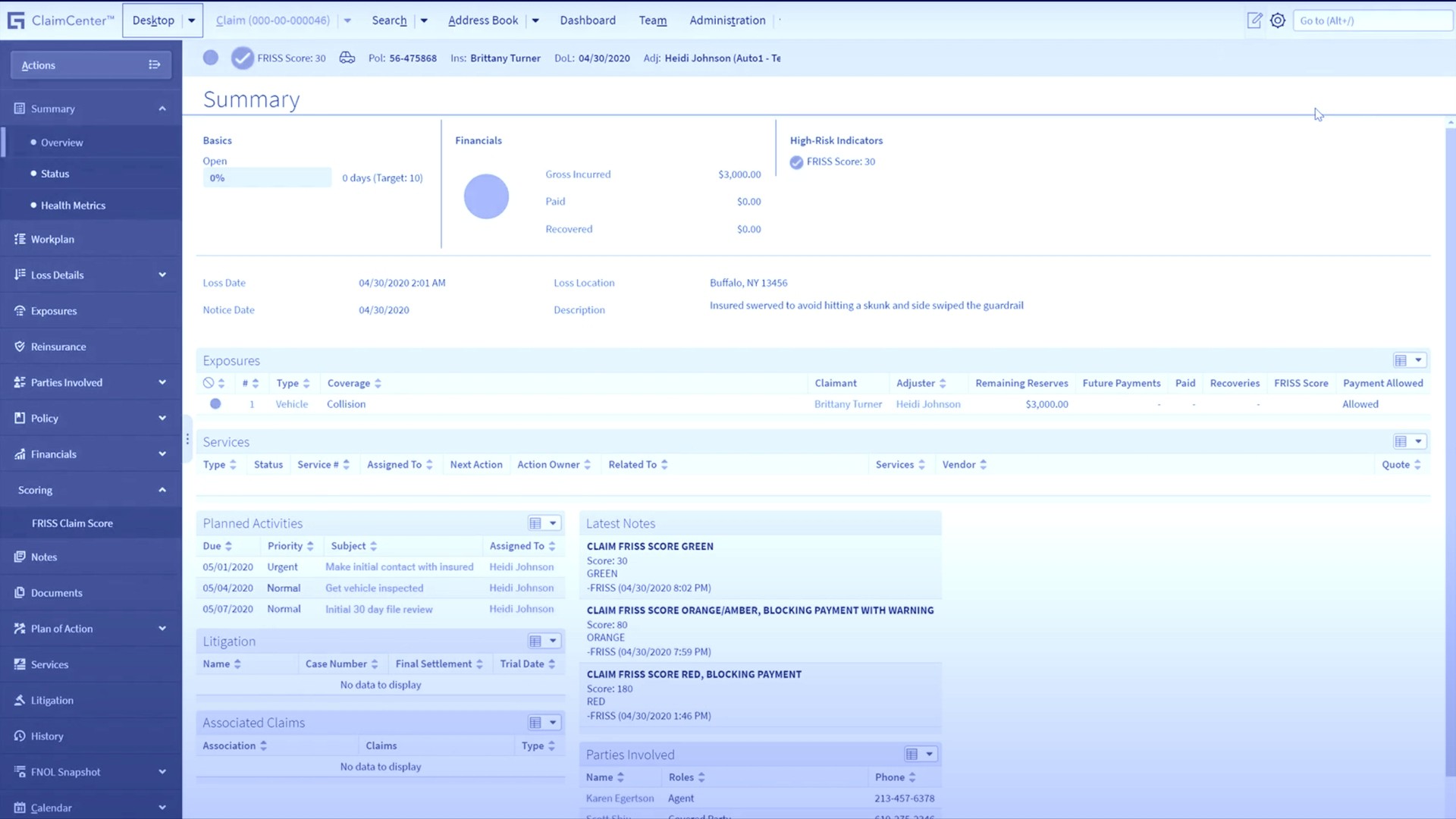

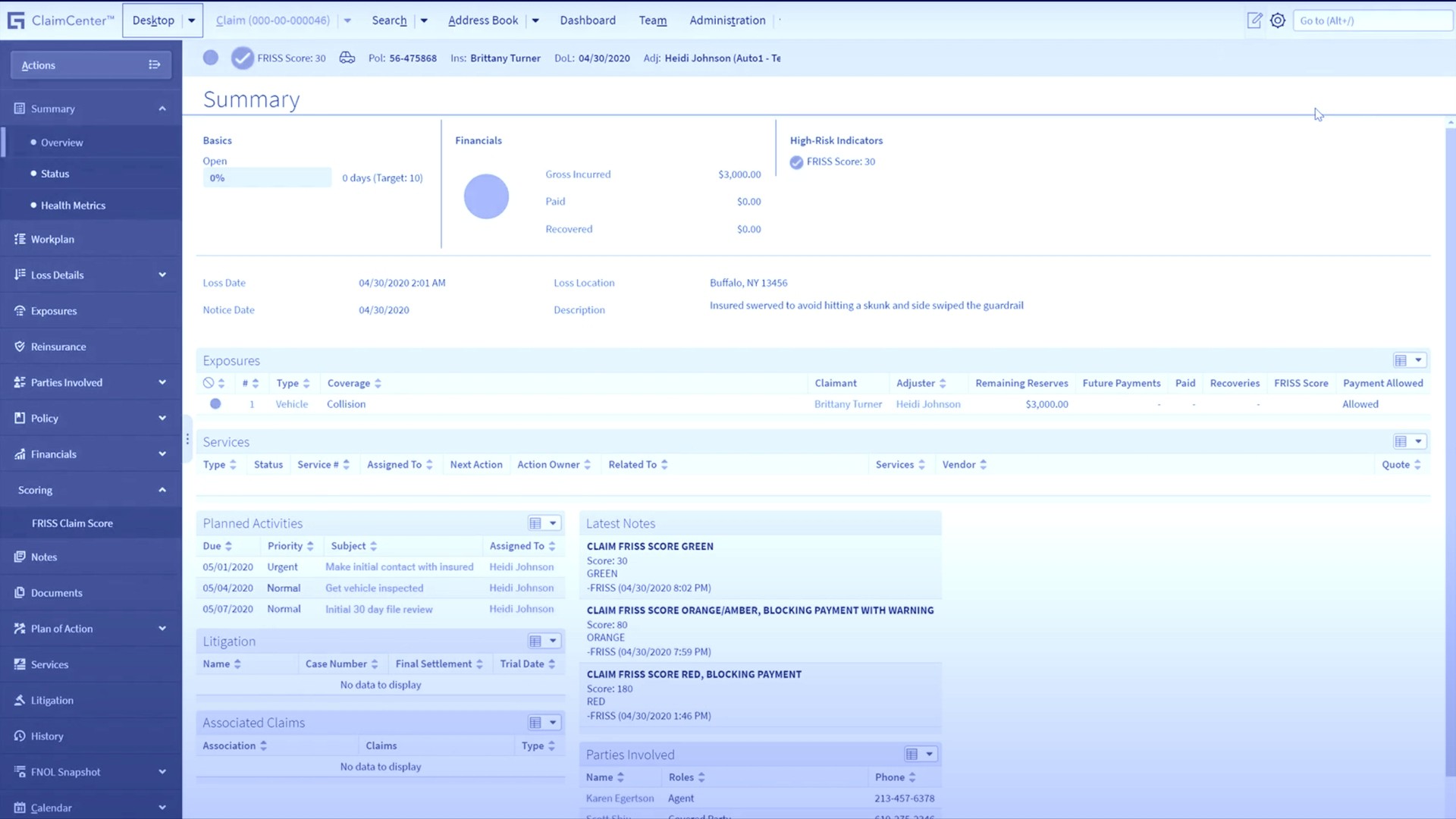

It is important that decisions should always be explainable. FRISS helps in this by sending all explanations along with the screening.

Tier 1 Carrier

CX Expert

It is important that decisions should always be explainable. FRISS helps in this by sending all explanations along with the screening.

Tier 1 Carrier

CX Expert

It is important that decisions should always be explainable. FRISS helps in this by sending all explanations along with the screening.

Tier 1 Carrier

CX Expert

Automated company identification with

compliance screening and audit trails

Automated company identification with compliance screening and audit trails

Data harvesting

Dynamic determinations

Image analytics

Language processing

Data harvesting

Dynamic determinations

Image analytics

Language processing